- 2017 TAXES TURBOTAX CALIFORNIA PDF

- 2017 TAXES TURBOTAX CALIFORNIA FULL

- 2017 TAXES TURBOTAX CALIFORNIA SOFTWARE

It provides a simple interface where you can enter details such as what you do for a living, whether you own a home, if you have any children, and charitable donations you made in the year.

2017 TAXES TURBOTAX CALIFORNIA SOFTWARE

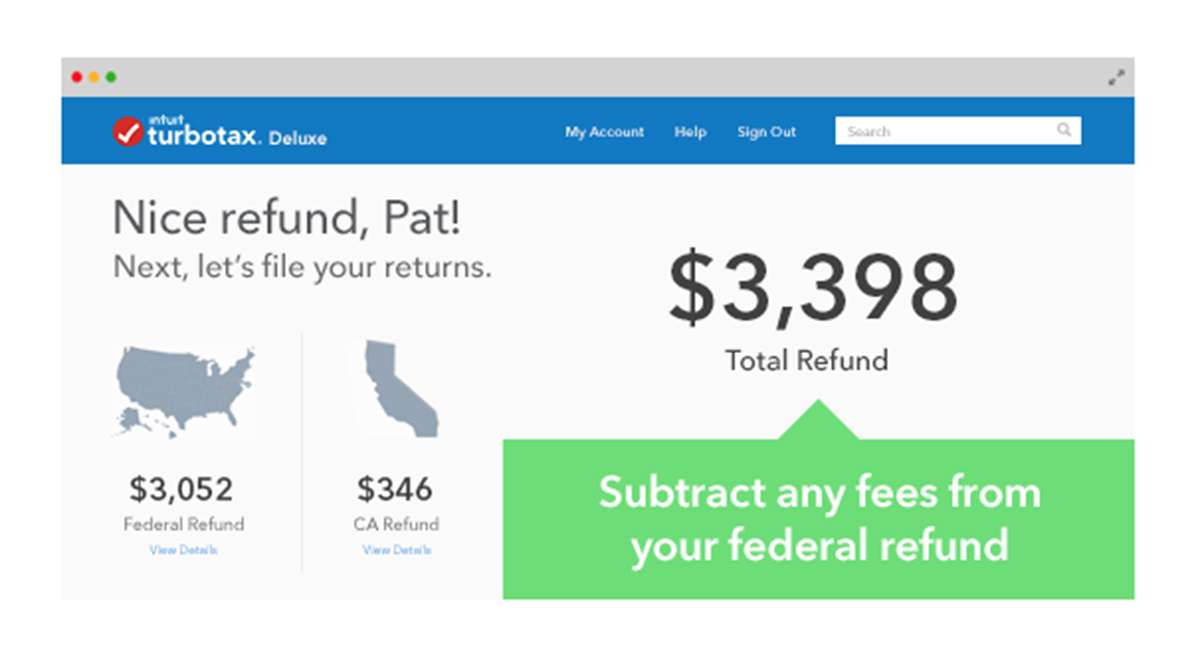

The Deluxe version of the software is the most cost effective and there are also Premier and Home & Business versions available, which offer more features at a higher cost. TurboTax 2017 can be used to prepare and file tax returns for USA and Canada. The current tax year is 2021, and most states will release updated tax forms between January and April of 2022. Income Adjustment Schedule Section A Income.

2017 TAXES TURBOTAX CALIFORNIA PDF

TurboTax Deluxe was first developed in the 1980s and has since become the leading tax creation software on the market. California has a state income tax that ranges between 1 and 13.3, which is administered by the California Franchise Tax Board.TaxFormFinder provides printable PDF copies of 175 current California income tax forms. 2017 California Adjustments Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule.

Individual Income Tax Return, to correct your tax return. If you need to file one, these tips can help. TurboTax Deluxe guides users through the tax process, helping them every step of the way and making sure they get the deductions that they deserve. You can fix mistakes or omissions on your tax return by filing an amended tax return. Terms and conditions may vary and are subject to change without notice.

2017 TAXES TURBOTAX CALIFORNIA FULL

It makes the process simple, quick and easy, with a host of features that can help first timers adjust to the tax filing system. Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premier, Self-Employed, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through. Here's who must pay California state tax & what's taxable. If you don’t have an accountant and if you find the tax system daunting then TurboTax Deluxe could be the perfect application for you. California state tax rates are 1, 2, 4, 6, 8, 9.3, 10.3, 11.3 & 12.3. Simply select the year that you need to complete your taxes and well show you which version you need to file a previous years tax return. TurboTax Deluxe is perfect for small business or individuals who want to quickly and easily process their tax returns. TurboTax CD/Download software is the easy choice for preparing and filing prior-year tax returns online. There are a number of versions of the TurboTax Deluxe software and it is generally released every year to cover the taxes for that year. TurboTax Deluxe is an application that is used to create and file US taxes.

0 kommentar(er)

0 kommentar(er)